- Copay Plan Vs High Deductible

- Understanding Copays And Deductibles

- Copay Coinsurance Deductible Defined

- Medical Insurance Copay And Deductible

- $20 Copay Before Deductible

You'll pay either our full copay rate or reduced copay rate. If you live in a high-cost area, you may qualify for a reduced inpatient copay rate no matter what priority group you're in. To find out if you qualify for a reduced inpatient copay rate, call us toll-free at 877-222-8387. We're here Monday through Friday, 8:00 a.m.

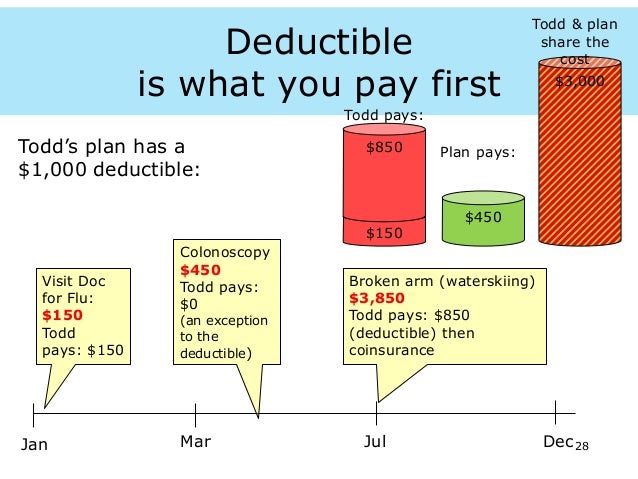

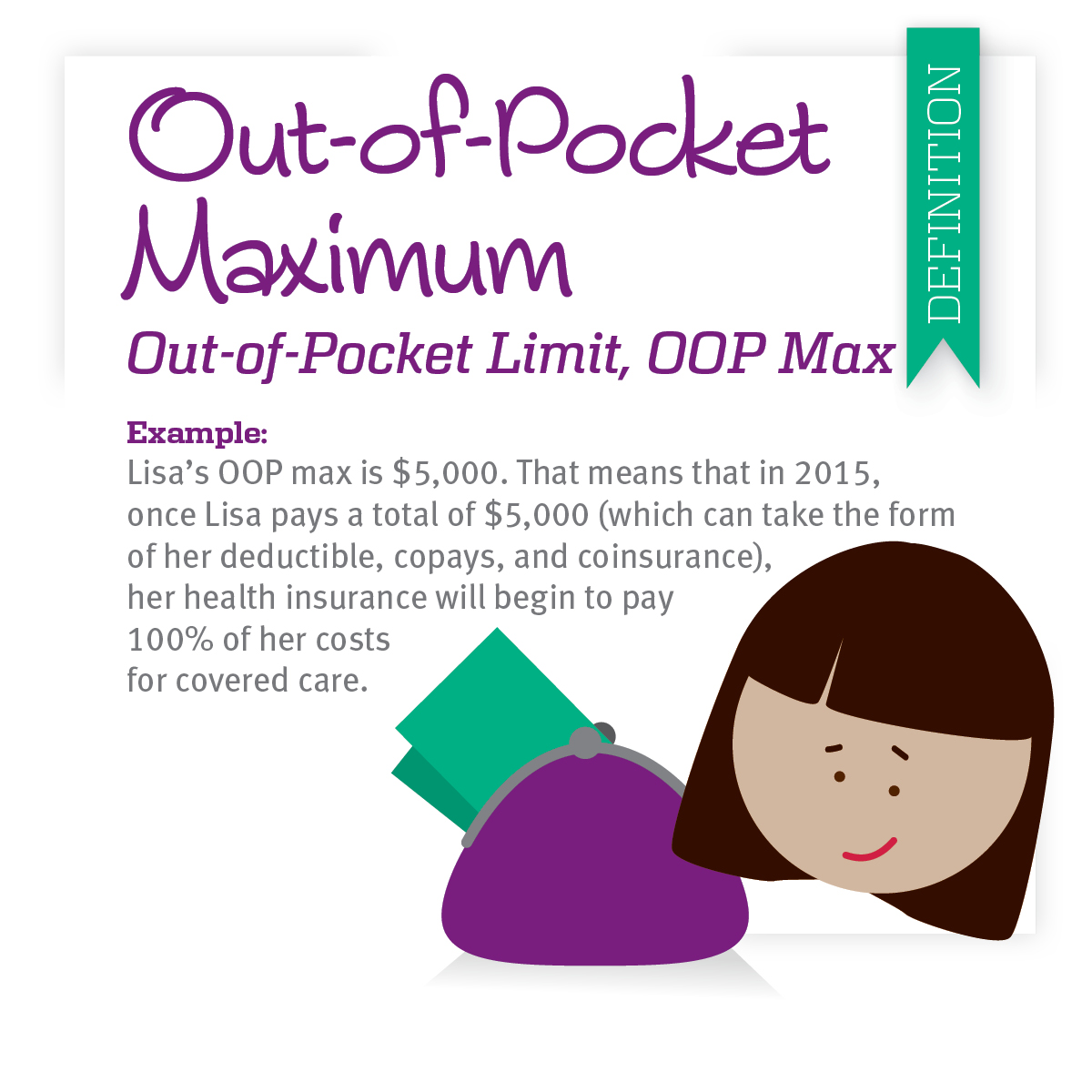

In title insurance, it also means the sharing of risks between two or more title insurance companies. In health insurance. In health insurance, copayment is fixed while co-insurance is the percentage that the insured pays after the insurance policy's deductible is exceeded, up to the policy's stop loss. High-deductible plans. High-deductible health plans, also referred to as “consumer-directed” plans, are plans whose deductibles surpass a limit set by the IRS.For 2015, those deductibles are. When health insurance deductibles are often measured in thousands of dollars, copayments—the fixed amount (usually in the range of $25 to $75) you owe each time you go to the doctor or fill a prescription—may seem like chump change. But copays really. Let’s say that your health insurance plan has a $1,000 deductible and 20 percent co-insurance and you use $10,000 in services. In this case, you will be required to pay the $1,000 plus 20 percent of the remaining $9,000, up to your total out-of-pocket maximum.

As we age, both dental care becomes more important, yet 70 percent of Medicare recipients have gone over a year without visiting a specialist. Both dental and vision benefits are available as part of Medicare Advantage, as standalone insurance, or through discount plans, with some even offered at a senior discount.

Need some oral work or an eye exam done and want help paying for it? Keep reading for specifics about your eligibility for coverage and various plan types from companies already serving members from coast to coast.

Why Do I Need Dental and Vision Insurance?

Older adults are seven times more likely to develop oral cancer, which could be prevented by maintaining regular dental care. The possibility for other problems, such as gum disease, a risk factor for heart disease, also increases nearly 50 percent for individuals over the age of 65. Even dry mouth, a seemingly benign condition, can lead to more cavities, infections, and sores.

Routine dental care has the power to detect and prevent most of these issues. Nevertheless, dental care is rarely cheap. Basic cleaning and exams cost $150-$350 on average, and more complex procedures like bridges and implants can easily make a single dental visit cost over $1,000.

Per the American Optometric Association, adults over 61 years old should receive an eye exam once per year. That’s no surprise since approximately one in three individuals has some type of vision-reducing eye disease by age 65. Plus, many eye conditions, such as diabetic retinopathy, macular degeneration, and cataracts, are age-related and most treatable if dealt with early.

Unfortunately, vision care is hardly more affordable, with the average eye exam costing between $150 and $200. And the average price tag for basic single lens glasses at an eye doctor or independent eyeglasses shop is nearly $400 without insurance.

Luckily, there are plans out there that address both of these issues. A standalone plan that bundles dental and vision care or a Medicare Advantage plan of your choice can make getting the care you need affordable again.

Dental and Vision for Medicare Recipients

Original Medicare (Part A or B) doesn’t cover routine dental or eye care. This means that without additional coverage, you’ll be expected to pay full cost for most oral and visual needs, including prescription eyewear.

Copay Plan Vs High Deductible

The good news is there are a few situations where Medicare A or B will help you out with dental or vision needs. Medicare usually covers emergency dental procedures that require a hospital stay or complex surgeries that require dental exams. Additionally, if you’re eligible for both Medicaid and Medicare, some dental costs, including dentures, are also typically covered. Medicare Part B will also cover an annual exam for eye diseases, such as macular degeneration or glaucoma.

Can Medicare Advantage or Medigap Cover Dental and Vision?

Medicare Advantage plans, sold by private companies, often include some dental and vision coverage. However, not all plans have these added benefits. Their premiums, benefits, and deductibles vary, as with all health plans, and many people refer to them as “all-in-one” plans.

Medigap is supplemental insurance created to cover gaps in Original Medicare, such as deductibles and copays. Medigap will cover some coinsurance or deductible costs for emergency oral surgery or treatment of serious eye diseases, but Original Medicare also covers part of those expenses. Medigap does not cover routine eye or dental care.

Tip: You can’t use Medigap and Medicare Advantage together. In fact, it’s illegal for someone to sell you a Medicare Advantage plan if you have Medigap.

Standalone Individual Dental and Vision Bundles

Standalone dental plans are available for purchase. Some even offer plans designed with older adults in mind. In contrast to Medigap, Original Medicare, and a large number of Medicare Advantage plans, standalone plans and bundles ensure you’re covered for every type of dental and vision care you need.

By selecting a standalone bundle with dental and vision, you’ve made your life that much easier. Rather than finding, enrolling in, paying for, and keeping track of plans from two insurers, you’ll only need to manage a single account. Since the majority of these plans are individualized, many insurance providers do not name prices upfront, but some do. All carriers encourage you to call or fill out your information online to receive a detailed quote.

Here are three providers that offer dental and vision care, some as part of Medicare Advantage and others as standalone insurance.

Aetna Insurance

With more than a century in the business, Aetna now insures over 22 million members, including nearly 13 million dental members. Once you’re a member, you can use Aetna’s online database to find a dentist or eye doctor in your area.

Aetna Standalone Insurance

Understanding Copays And Deductibles

Aetna Dental Direct is Aetna’s standalone dental insurance. Aetna Dental Direct’s PPO plans allow you to see any dentist you want. Monthly premiums vary based on locations, ranging from $51 to $79 for most older adults. Annual benefit maximums are usually about $1,250.

With Dental Direct, you’re covered for preventative, basic, restorative, and major procedures. Most plans cover preventative work at 100 percent, basic services at 50 to 80 percent, and major works at 50 percent. Unfortunately, basic benefits (fillings, simple extractions, etc.) don’t kick in until six months after your plan begins. Major services (roots canals, bridges, and dentures) are not covered until after 12 months.

Although the premiums likely aren’t worth the cost if you solely need preventative care, anyone prone to dental issues or anticipating the need for major services is likely to at least break even with this plan.

Vision Plan from Aetna

Web scrape python. Aetna Vision Preferred is available as an add-on option to Aetna Dental Direct. This plan covers a detailed eye exam cost entirely, including a $130 allowance for eyewear (with 20 percent off after $130). There is no deductible or waiting period, and certain plans provide extra discounts for adults over 65.

Aetna Medicare Advantage

With many Aetna Medicare Advantage plans, you’ll have access to dental, hearing and vision coverage, all from a single insurance provider. Aetna provides both HMO and PPO plans, based on where you live. Aetna Medicare Advantage also offers more than five different plans that include dentistry and vision benefits with monthly premiums starting at $0 per month and usually not reaching any higher than $35.

Depending on your plan, Aetna Medicare Advantage with dental, vision, and hearing benefits covers up to a $4,500 maximum benefit for preventive and comprehensive dental, $2,000 toward hearing aids per ear, and $500 worth of prescription eyewear each year. Additionally, plans include as much as $225 toward over-the-the-counter medications every three months.

United Healthcare

In its nearly 50 years of operation, UnitedHealthcare has become the largest health insurance provider in the United States, covering over 45 million people and partnering with over 1.2 million healthcare providers and 6,500 hospitals nationwide.

United Healthcare Dental

United Healthcare, based in Minnetonka, Minnesota, features several standalone dental plans specifically for older adults, in addition to more general options. Plans geared towards older people frequently include hearing aid coverage and audiology exams as well as dental aid. Most dental plans cover 70 to 80 percent of treatment costs, and there is typically an annual maximum from $1,000 to $3,000.

United Healthcare Vision

In most states, United Healthcare allows you to add vision insurance as a rider to your dental plan for an additional premium. United’s vision insurance costs are low. Underwritten by Golden Rule Insurance Company, United charges a $10 copay for a comprehensive eye exam in-network and will pay up to $50 for a non-network exam.

For eyewear, United Health covers up to $150 for frames purchased from a network provider and a $10 copay for lenses. Contacts, on the other hand, have no copay and are covered for up to $150. Another aspect that makes United Healthcare vision insurance great is its discount on Lasik procedures.

United Healthcare Medicare Advantage

United Healthcare also provides Medicare Advantage coverage that includes vision, dental and hearing. Of course, its discount percentages don’t quite match those of standalone plans or the benefits from most of Aetna’s Medicare Advantage selections.

Tip: Many eye diseases develop painlessly, displaying no symptoms or vision impairment until your condition is quite progressed. Fortunately, smart health choices, such as routine eye examinations, can help in early detection, minimizing damage to your vision and health long term.

Delta Dental

Delta Dental is the world’s leading provider of dental insurance, covering nearly 80 million Americans. Established in 1954 and headquartered in Oak Brook, Illinois, Delta Dental offers PPO and HMO dental care plans, which can be bundled with DeltaVision, a vision plan that offers pre-negotiated discounts on eye exams, glasses, contact lenses, and laser vision correction.

Copay Coinsurance Deductible Defined

DeltaCare USA Plan

One of Delta Dental’s most well-known plans for individuals is the DeltaCare USA (HMO) Plan, which offers 100 percent coverage on preventative care with neither an annual maximum nor deductible. It also offers orthodontic coverage, something becoming increasingly popular among older adults.

Monthly premiums are generally between $8 and $15, depending on your location, and there is no waiting period for any service. Unfortunately, this plan limits members to a smaller number of care facilities than other plans, and referrals are required to see a specialist. There is also a six-month waiting period for basic and restorative care, such as fillings, crowns, and root canals.

Delta Dental PPO

Another one of Delta’s most popular standalone dental plans is Delta Dental PPO gives members their choice of network providers and reduced fees. The plan deductible is $50 for an individual and there is a $1,500 benefit maximum per year. However, preventative care is covered 100 percent. Additionally, after six months, you’ll only pay 20 to 50 percent of the agreed cost for most procedures. Monthly premiums cost between $40 and $70, depending on location,

If this cost is too high, the company offers discount plans (Delta Dental Patient Direct) in select states that usually save customers 15 to 45 percent. Monthly premiums cost between $40 and $70, depending on location.

DeltaVision

Medical Insurance Copay And Deductible

DeltaVision plans may be available separately or as a part of your dental insurance. DeltaVision members save an average of 71 percent off the retail price for eye exams and glasses with in-network doctors. With DeltaVision, you can visit a popular retailer such as TargetOptical or purchase eyewear online. Additionally, Delta Dental offers members up to 50 percent off Lasik procedures.

Recap

Regular dental and vision care are critical to healthy aging. Older adulthood brings about more threats to our health, but that doesn’t have to be anxiety-inducing. Sign up for dental and vision insurance through a standalone or Medicare Advantage plan, so you can spot issues before they become harmful to your health.

Frequently Asked Questions

- Which plans cover dental emergencies while I’m out of the country traveling?

Most emergency procedures you might need while overseas would qualify under healthcare. Of course, it’s wise to always check your individual plan, as occasionally some dental plans will cover foreign work as well.

- Why should I bundle my dental and vision coverage?

Bundling your dental and vision insurance will often get you a discount. Since the insurance company knows it’s getting two premiums from you each month, the probability of them offering you a lower rate is higher. It also often limits the number of benefits identification cards you have to carry around and number of passwords and usernames you need to keep track of. These bundles frequently come with extra perks such as a free or unexpected services, which may or may not be related to the insurance.

- What’s the difference between insurance and a discount plan?

Similar to dental insurance, discount plans require that you pay a monthly premium. After your deductible is met, your insurance pays all or a set percentage of your covered dental expenses until you meet your benefit maximum for the year. Insurances may require a waiting period for all coverages or certain types of coverage, so you should read the fine print on any plan you select.

- Do any of the vision plans cover LASIK?

Minecraft shaders for windows 10 version. Many providers, including those listed here, offer at least one plan with partial payment or discounted fees for laser eye surgery. DeltaVision pays up to 50 percent, which is the highest I’ve seen.

- Are there dental and vision plans that offer spouse coverage?

Spouses are often eligible to be added to any standalone plans you select for an additional premium. However, you can not add your spouse to any part of your Medicare or Medicare Advantage Plan.

$20 Copay Before Deductible

Amie has been writing about senior care products and services for the last decade. She is particularly passionate about new technologies that help improve the quality of life for seniors and their families. Seeing her parents and grandparents age made Amie ask herself, “Would this be good enough for my loved ones?” In her spare time, Amie enjoys outdoor adventures and spontaneous road trips. Learn more about Amie here